nj property tax relief fund 2020

Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. Eligibility requirements including income limits and benefits available under this program are subject to.

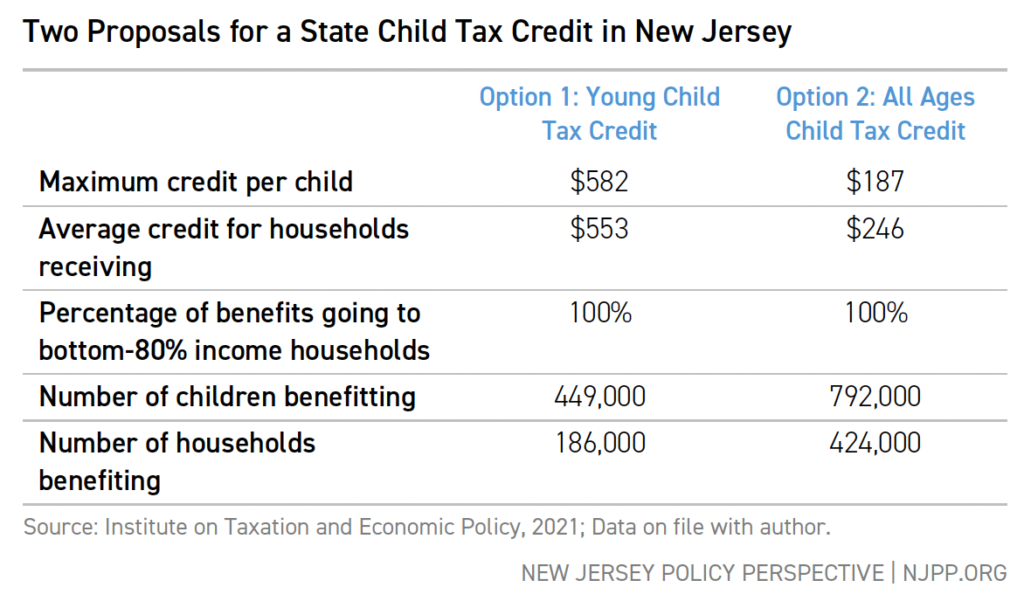

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

In New Jersey localities can give.

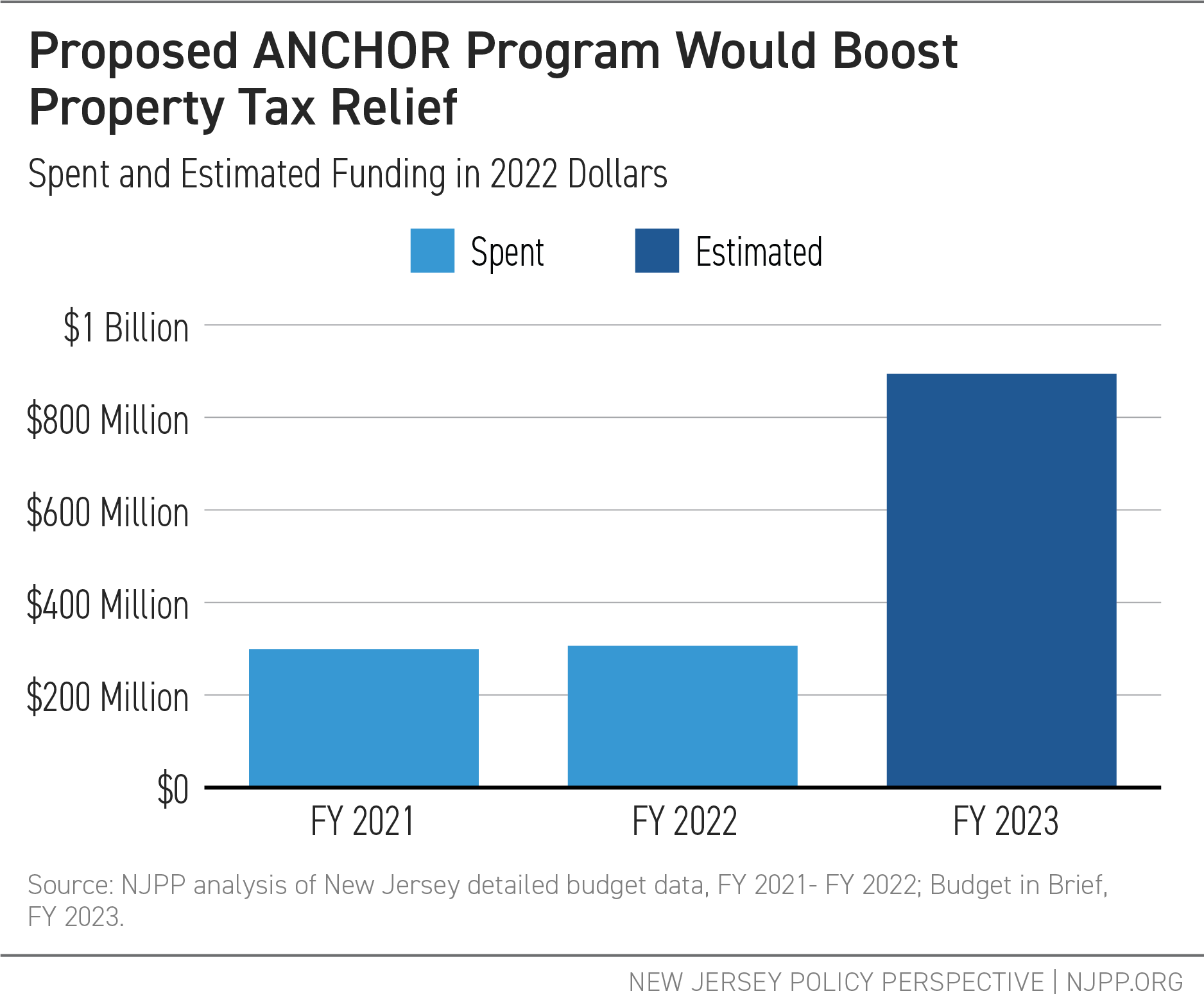

. As a part of his FY2023 Budget Proposal Governor Murphy touted the new initiative that will distribute 900 million in property tax relief to nearly 18 million. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. 2021 Senior Freeze Applications.

Stay up to date on vaccine information. Forms are sent out by the State in late Februaryearly March. So any personal income tax refunds come out of the Property Tax Relief Fund.

Phil Murphy unveiled Thursday. NJ Mortgage Property Tax Relief Program Coming Amid COVID. New Jersey A4030 2022-2023 Makes supplemental appropriation of 80 million from Property Tax Relief Fund to DOE for Stabilization Aid.

Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. The rebates will be hitting the mail as soon as July 1 sending 500 to over 750000 New Jersey families. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline.

Beginning with tax year 2020 the Middle Class Tax Rebate will be issued to eligible New Jersey residents that file a 2020 resident Income Tax return NJ-1040 with a balance of tax 1 or more. New Jersey Gov. Homeowners negatively affected by.

Have to be current on mortgage and property taxes as of January 2020. We will begin mailing 2021 applications in early March 2022. NJ Division of Taxation - Local Property Tax Relief Programs.

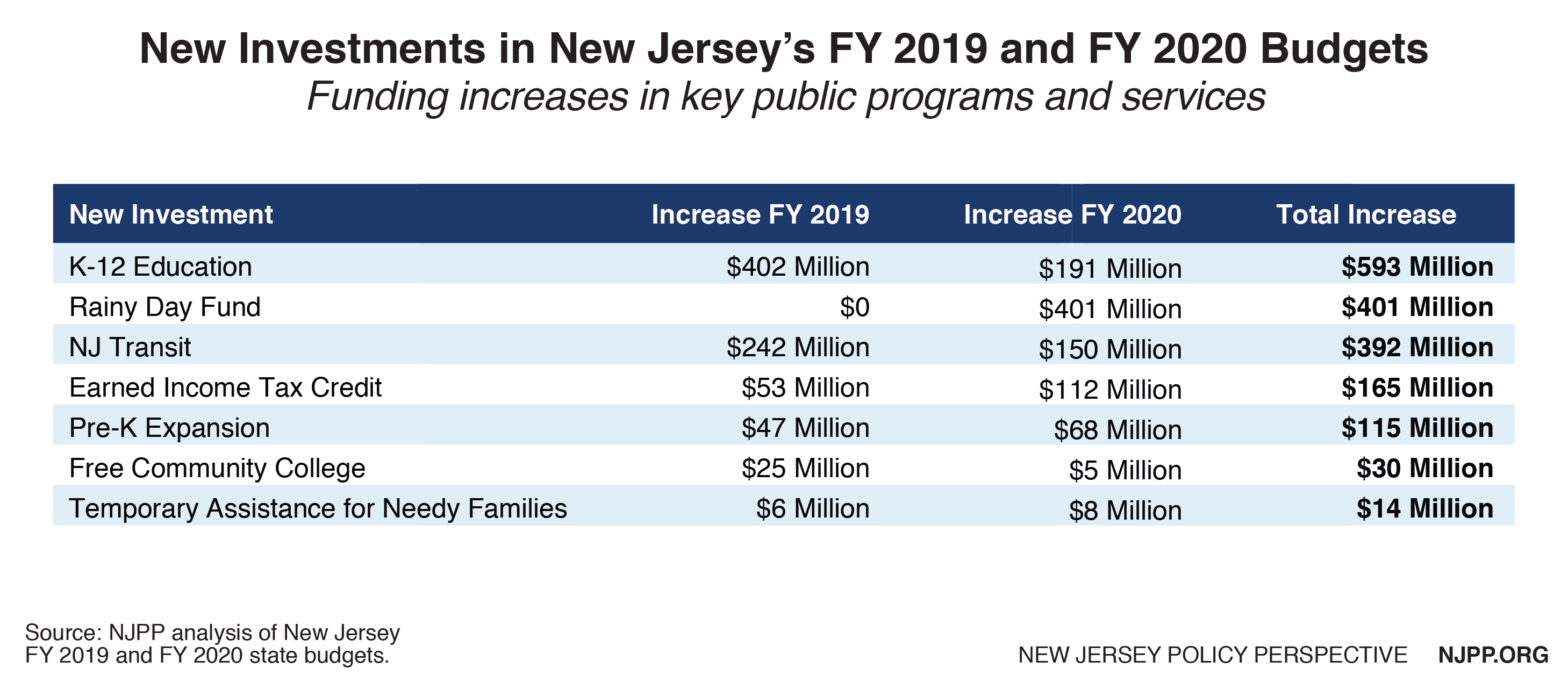

All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. We will begin mailing 2021 applications in early March 2022. 09 2020 5 New Jersey homeowners will not receive Homestead property tax credits on their Nov.

Besides education property taxes in NJ also fund. Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. So any personal income tax refunds come out of the Property Tax Relief Fund.

In New Jersey localities can give. Utilizes 3259 million of federal Homeowner Assistance Fund. NEW JERSEY Governor Phil Murphy Thursday visited Somerville to further highlight the ANCHOR Affordable New Jersey Communities for Homeowners and Renters Property Tax Relief Program.

To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms. The up to 35000 payment would come in the form of a three-year forgivable loan which would be listed as a lien on the property with no.

Forms are sent out by the State in late Februaryearly March. That means if the amount on line 50 is less than 500 you will receive a check for the amount shown on line 50. Book A Consultation Today.

Phil Murphy wants to increase how much the state spends each year on property-tax relief benefits so more New Jersey residents can receive them. Call NJPIES Call Center. COVID-19 is still active.

The rebate amount is equal to the tax paid after credits line 50 up to a maximum amount of 500. For Immediate ReleaseApril 15 2020. Capital gains and the exclusion of all or part of the gain on the sale of a principal residence are calculated in the same manner for.

Property Tax Relief Programs Homestead Benefit. Senior Freeze Property Tax Reimbursement Program. New Jersey homeowners struggling to pay their mortgage or property taxes can apply for up to 35000 in aid when the state opens its application portal on Feb.

County and municipal expenses. Capital gains in excess of the allowable exclusion must be included in income. Out of State Residents.

All property tax relief program information provided here is based on current law and is subject to change. The deadline to file the application is October 31 2022. The main reasons behind the steep rates are high property values and education costs.

If its approved by fellow Democrats who. Letter of Ineligibility for. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits.

TRENTON - The Department of the Treasury today reported that March revenue collections for the major taxes totaled 1888 billion up 663 million or 36 percent above last March. Tax rebates will be issued as a paper check separate. Fiscal year-to-date total collections of 22398 billion are up 13 billion or 62 percent above the same period last year.

The application portal opens on Tuesday February 8. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. If the amount on line 50 is 500 or more you will receive a check for 500.

NJ Mortgage Property Tax Relief Program Coming Amid COVID Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have been unable to pay housing bills due to COVID-19. The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. Im proud to say that three of the five lowest property tax increase ever on.

Nj Property Tax Relief Program Updates Access Wealth. Have a copy of your application available when you call. Phil Murphy s proposed 324 billion spending plan includes 275 million for the property tax relief program which lowers tax bills.

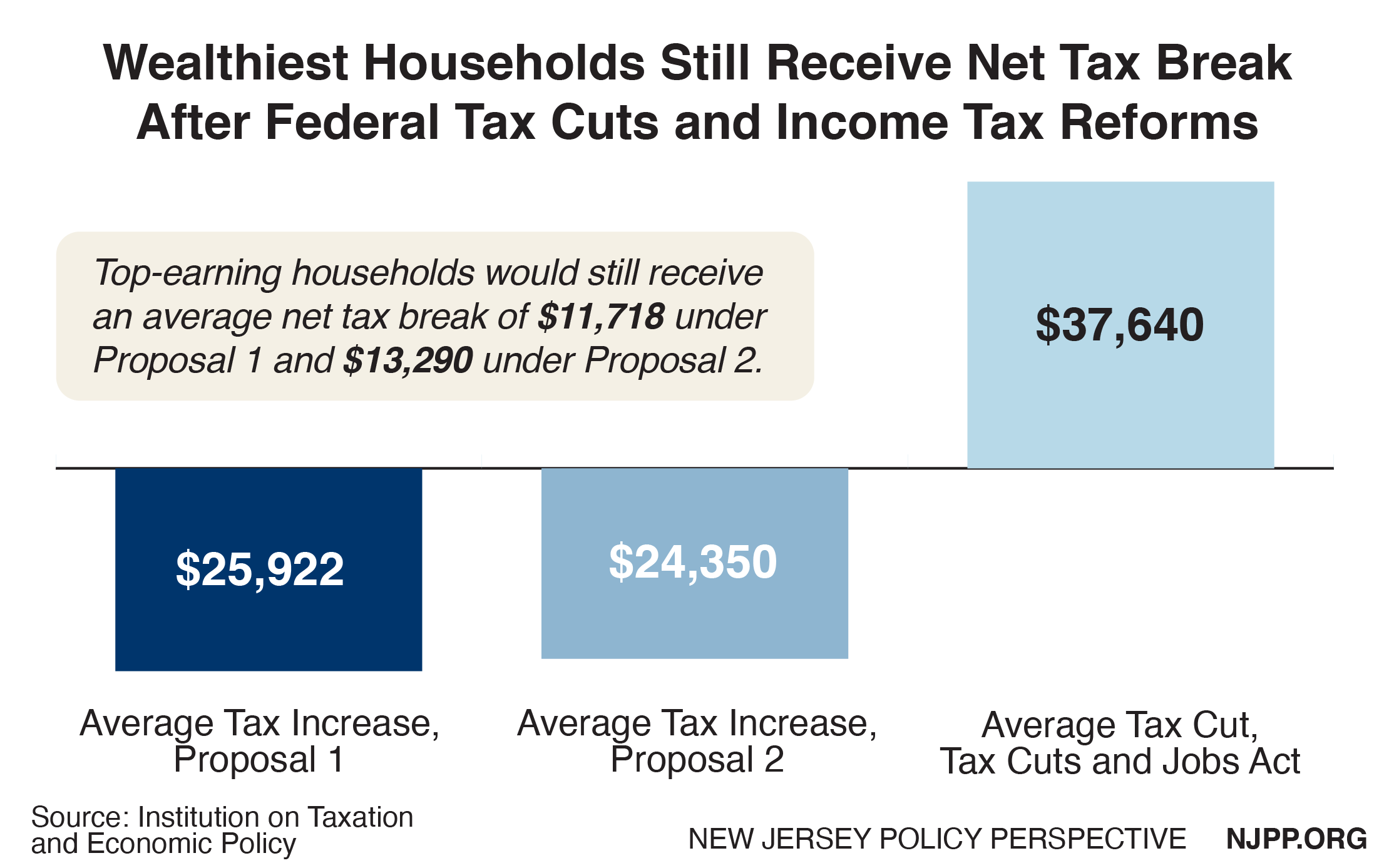

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Florida Property Tax H R Block

The Official Website Of City Of Union City Nj Tax Department

Deducting Property Taxes H R Block

Breaking Down Governor Murphy S Fy 2023 Budget Proposal New Jersey Policy Perspective

Tax Assessor Township Of Franklin Nj

The Official Website Of City Of Union City Nj Tax Department

Tax And Water Collection Township Of Franklin Nj

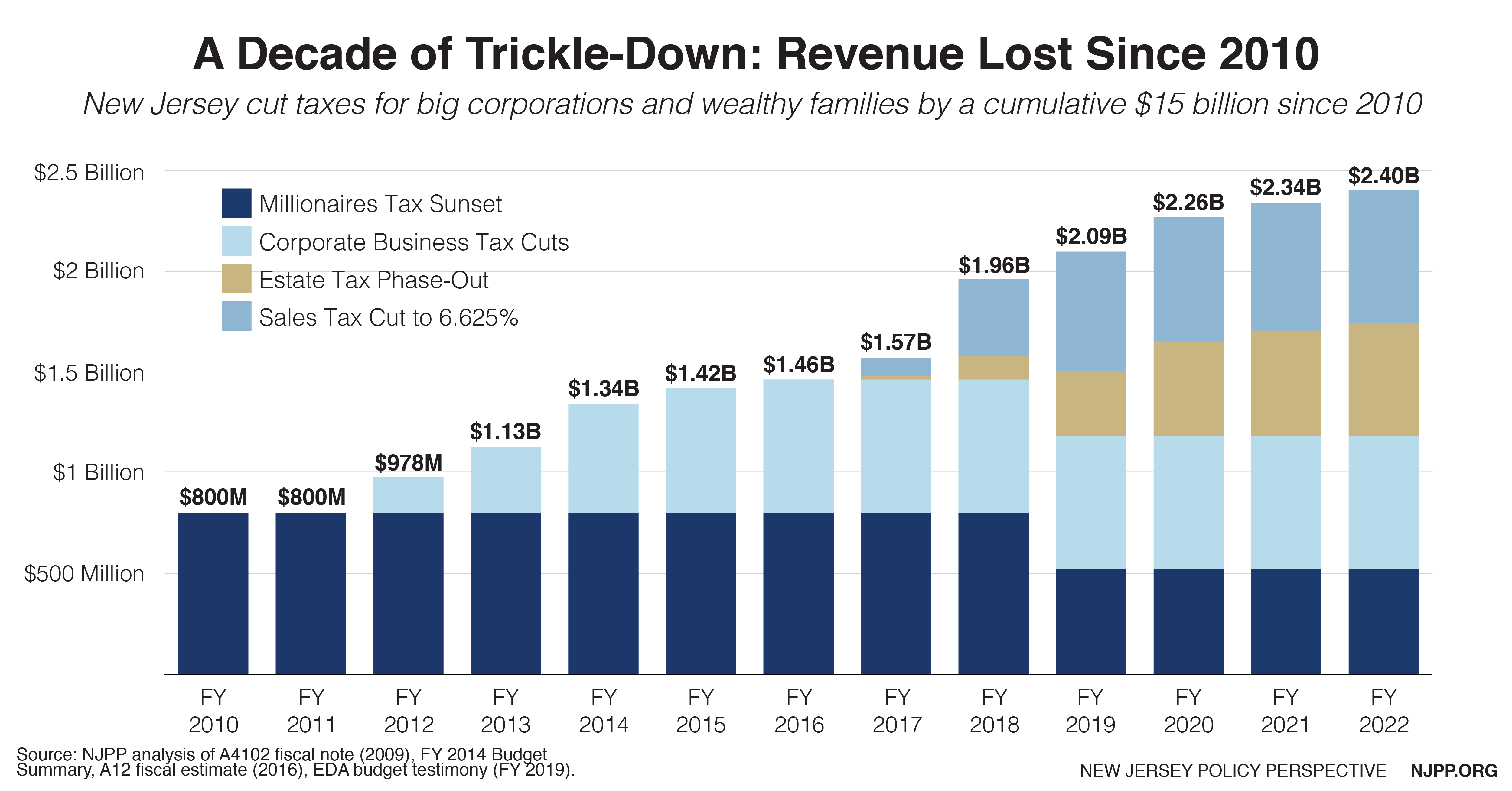

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

Nj Property Tax Relief Program Updates Access Wealth

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

State Local Property Tax Collections Per Capita Tax Foundation

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News